The impressive collapses of Tricolor, the subprime auto lender, and First Brands, an auto parts supplier, were the first signs of a larger turmoil. This was followed by the disaster of regional banks, which prompted JPMorgan CEO Jamie Dimon to warn about the possibility of new "accidents" toward the end of the economic cycle. If we add the signs that lower-income consumers have reached their limit, the overvalued valuations in the Artificial Intelligence sector, and Bitcoin's fall below $100,000, it's not surprising that many are wondering if the rising financial pressure indicates the start of a wider recession.

The warning signs

Another warning sign is the new data from S&P Global, published this week, according to which, by October, 655 companies have filed for bankruptcy, a number approaching the total of 687 for 2024. The S&P Global data shows that in October alone there were 68 new bankruptcy filings. In August, filings reached 76, the highest monthly number since 2020.

The industrial sector leads the categories with 98 filings, reflecting the vulnerability of the industry to supply chain problems related to tariffs. This is followed by consumer goods companies, with 80 bankruptcies this year.

At the current rate, corporate bankruptcies could reach the highest level in the last 15 years by the end of the year.

The alarm bells ring

The collapse of Tricolor and First Brands in the autumn was certainly a loud wake-up call. The problems of regional banks and the exhaustion of lower- and middle-income consumers, combined with the recession in the latter part of the year, indicate an economic slowdown. The historical 43-day government shutdown caused even more problems.

"I view these few incidents as idiosyncratic, but I expect more of these 'isolated events' to occur, potentially in other sectors like software, which has increased leverage in the market while capital flows are directed towards Artificial Intelligence investments," said Clayton Triick, Head of Public Strategies Portfolio Management at Angel Oak Capital Advisors, to S&P Global Market Intelligence.

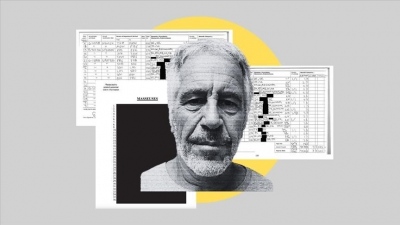

The most significant bankruptcies of 2023 follow.

Dimon's warning

In mid-October, JPMorgan CEO Jamie Dimon caused a stir in the banking and financial world with the following statement: "My antennae go up when such events happen. Perhaps I shouldn't say it, but when you see one cockroach, there are probably others."

UBS analysts, led by Jonathan Pingle, recently informed their clients: "Our basic assessment is that there will be no decline in stock markets. Households will suffer for the next two quarters."

However, Pingle noted that the boost in disposable income by $55 billion in the second quarter of 2026, due to retroactive tax relief from the One Big Beautiful Bill Act (OBBBA), will boost consumer sentiment next spring. Furthermore, all the infrastructure, factory reconstruction, data center construction, and much more, are expected to affect the real economy early next year, just before the midterm elections.

From now until the appearance of positive economic winds, the Trump administration has launched Operation Affordability, aiming to reduce prices to boost lower-income consumers and improve the climate ahead of the elections.

www.bankingnews.gr

Σχόλια αναγνωστών