The EU is drowning in debt while Russia plays with the dollar

The European Union is moving decisively toward the introduction of eurobonds. At the discrete EU preparatory meeting at Alden Biesen Castle in Belgium, several signs indicate that Mario Draghi’s plan may soon be put into effect. At the same time, geopolitically, the possibility of Russia's return emerges as a new challenge for Brussels.

The ability to analyze mistakes and logically estimate realistic actions belongs, in evolutionary terms, to the conditio humana. Experience teaches: those who repeatedly hit their head against the same wall do not constitute evolution's preferred leadership model. Headaches should be understood as warning signs rather than a motive for the next attack. This introductory observation highlights a fundamental problem of modern Europe.

Political elites are conducting a socialist field experiment: they repeatedly throw themselves at the same wall—that of the European economy, businesses, and approximately 450 million citizens—without allowing repeated failures or headaches to stop them. One might assume this is an extremely complex structure. From the perspective of European politicians, however, it appears primarily as a challenge addressed with the fatal tools of central planning and stubborn ignorance.

The "diagnosis" of EU leaders

On Thursday, in Belgium, within the framework of the EU summit, we evaluated the state of this collective "head." The leadership circle around Ursula von der Leyen, along with political pillars Emmanuel Macron and Friedrich Merz, had correctly diagnosed the problem in advance: the European economy lacks competitiveness.

China and the United States are advancing technologically at speed—and have the audacity to position themselves diametrically opposite to Europe's ideology of central control and transformation logic. The two superpowers categorically refuse to hit their heads against the wall of European delusions—CO2 emissions elsewhere help plants grow and herds graze, while here "wind power" is produced alongside the deliberate destruction of the landscape.

Instead, they have moved toward radical market liberalization. The Chinese did it earlier; the Americans are now following at full speed, adopting what appears evolutionarily correct: they trust the social fabric back to the markets, individuals, and the principle of personal responsibility. European values regarding meritocracy, the revival of bourgeois culture, or even religion—Europe wants none of this.

Everything remains "woke," diligently selected by the supreme censor in Brussels. On the same day, the European Parliament stated that a trans woman is a woman—period.

The Draghi plan and eurobonds

The old familiar figure, former Italian Prime Minister and former head of the ECB, Mario Draghi, presented the plan for a supposed European recovery two years ago—and now he may define the EU's framework for action.

In the event of the Draghi plan’s implementation, a debt package of trillions of euros will be activated—public credit designed to launch Europe into green technology, artificial intelligence, digital infrastructure, and even defense technology to the level of its geopolitical competitors by 2030.

The fiscal framework defined by Draghi is massive: over five years, €800 billion annually will be directed to eurobonds—unless some rational politicians manage to stop this risky initiative. This corresponds to approximately 5% of EU GDP and would increase the total debt of member states by about 25%.

The test phase of this venture already took place with the NextGenerationEU bonds during the Covid period—at roughly the same volume. Most was ultimately absorbed by the European Central Bank. Demand for European debt remains modest, and funds were funneled into Southern European social welfare budgets and selected "green" prestige projects.

The implications for Germany

For Germany, the simultaneous introduction of eurobonds alongside the Draghi plan would mean the end of any hope for fiscal stability. The debt would increase by at least 5% annually, and with Germany's share in the new euro debt, by 2030 the country could easily exceed 110% of GDP.

Chancellor Friedrich Merz appeared unified at the summit alongside Emmanuel Macron, agreeing on the need to make Europe competitive again—particularly in industry, despite the fact that industry itself has suffered a blow from the policies Merz oversees: increased CO2 taxes, supply chain legislation, and energy policy that restricts industrial growth.

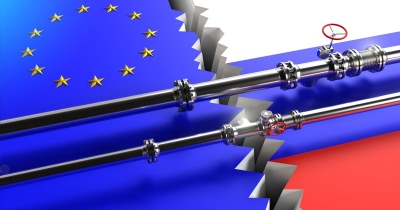

Russia and the dollar

According to an internal Kremlin document seen by Bloomberg, Russia is considering a potential return to the dollar payment system. After years of European sanctions, US embargoes, and exclusion from SWIFT, such a move would constitute a geopolitical shock, further isolating the EU and strengthening potential separatist tendencies, particularly in Eastern Europe.

The document describes areas of overlapping Russia-US interests: energy and raw materials cooperation, as well as the potential integration of dollar-based financial instruments into the Russian banking system. Reuters has confirmed a similar communication channel between Washington and Moscow.

Within this context, the strategy of Brussels appears in a different light. Perhaps this explains the EU's efforts to seek strategic partnerships with geopolitically critical states such as India or the MERCOSUR block. One common element unites the three superpowers: all find themselves in increasingly strained relations with Brussels and the leading capitals of the European Union.

www.bankingnews.gr

Σχόλια αναγνωστών