A new turn is taken in the discussion about the status of the gold reserves of the Banca d’Italia, as the Fratelli d’Italia (FdI) party of Prime Minister Giorgia Meloni insists on the need to record explicitly that “they belong to the Italian people”. Specifically, the issue has reopened through an informational note by the party, published by Repubblica and Corriere della Sera, titled “Oro di Bankitalia al popolo italiano: smontiamo le fake news”. The criticism expressed in the confidential memo is harsh and continues the dispute over the issue of the ownership of the gold reserves of the Bank of Italy. The memo states that Italy cannot make the mistake of allowing private interests to claim rights over the gold reserves of the Italians. For this reason, according to the document, a legislative provision is necessary to clarify ownership. The document also notes that in the share capital of the Bank of Italy are included banks, insurance companies, foundations, and pension funds headquartered in Italy; in many cases these are private entities, some of which are controlled by foreign interests. “Italy cannot run the risk of private entities, especially under foreign control, asserting rights over the gold of the Italians,” the FdI states, arguing that a legislative regulation is required to definitively clarify the issue of ownership of the reserves. The party of Meloni clarifies at the same time that the proposed regulation does not question the independence of the Banca d’Italia, nor does it violate the European institutional framework.

“Ownership of the organization”

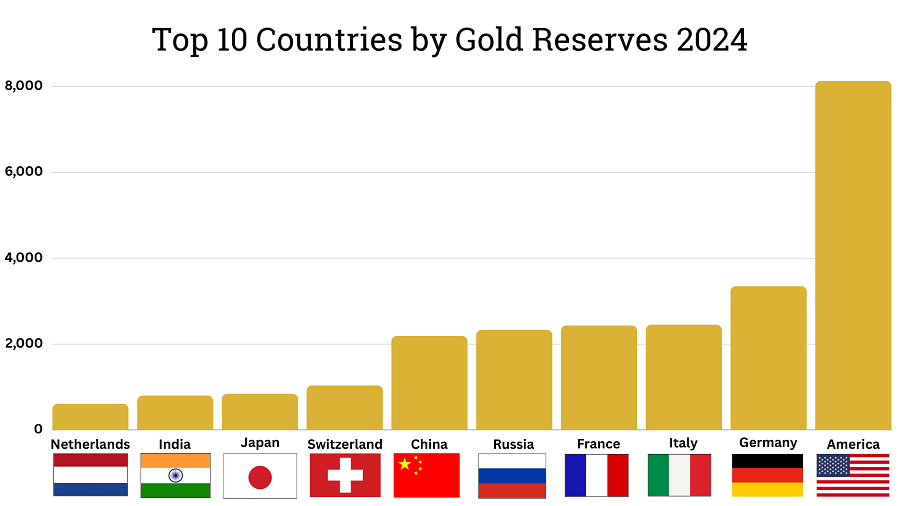

The Banca d’Italia itself states on its website that the gold is “property of the organization”, a fact that, as the FdI argues, makes even more necessary a clear provision that will secure that the gold collectively belongs to the Italian citizens. In recent days, the Italian government attempted to draft a milder version of the initial amendment. However, according to the European Central Bank, the changes made are not sufficient. Information even indicates that Christine Lagarde is furious. From Frankfurt they noted that “despite the amendments, the specific purpose of the proposal is still not clear”, essentially calling for further revision. The most recent version of the amendment, with first signatory the head of the Senate group Lucio Malan, states explicitly that “the gold reserves managed and held by the Banca d’Italia belong to the Italian people”. Whether this wording will be accepted by the ECB remains doubtful, but one thing is clear: the FdI does not intend to back down easily on an issue it considers politically and institutionally pivotal. It is noteworthy that Italy, through the Bank of Italy, holds approximately 2,450 tons of gold, one of the largest amounts worldwide.

Gold and economic sovereignty: Italy, Greece, and the reserves of central banks

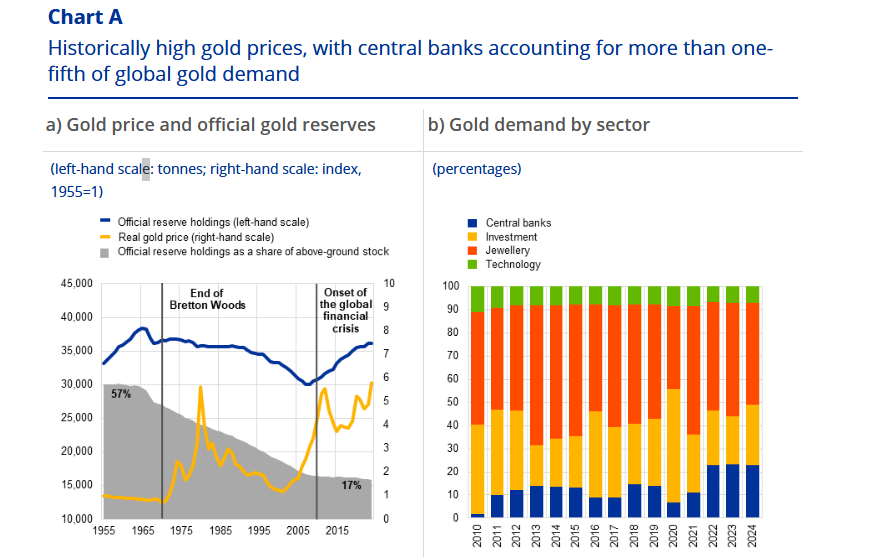

Almost every country in the world has gold reserves, which usually form part of international reserves along with foreign currencies and other monetary assets. Gold is recorded on the balance sheets of central banks, ministries of finance and debt management agencies. However, not all countries have a clear legal status for their gold. Legal ambiguity, at certain times, can lead to critical situations and raises questions: who is the real owner of the gold reserves and who can manage them? In Italy, for example, the gold reserves are recorded on the balance sheet of the Banca d’Italia, which operates as an independent company. This has led to discussions about whether the government can utilize the gold in emergencies or if the central bank has full management without state control. Italy holds about 2,452 tons of gold, the third largest reserve in the world after the US (8,133 tons) and Germany (3,350 tons). In the share of gold in international reserves, Italy reaches 71%, compared to less than 15% for the United Kingdom.

At the same time, Italy’s economic position remains difficult: public debt is expected to reach 139% of GDP, second only to Greece in the EU (153% of GDP), while the fiscal deficit exceeds 72 billion dollars. If we compare Greece with Italy, the questions remain similar. The Bank of Greece manages the Greek reserves, but who ultimately decides on their use? Could the gold reserves cover part of the fiscal deficit or support the economy in times of crisis? The Greek reserves are clearly smaller, but their management raises similar challenges. In Italy, political discussions about gold resurface periodically. Since 2018–2019, lawmakers and the government developed proposals to transfer the reserves under state control, arguing that the gold “belongs to the people”. Similar discussions could make sense in Greece, especially amidst fiscal pressures and rising precious metal prices.

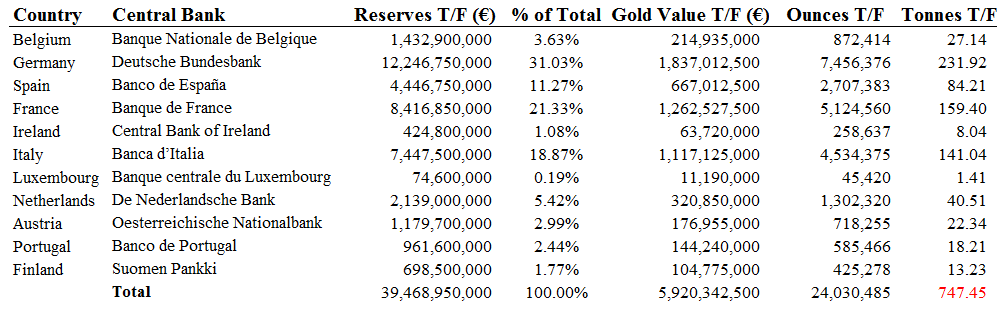

It is also important that a large part of the gold of central banks is stored abroad. In Italy, only 44.9% is located in Rome, while the remainder is at the Federal Reserve in New York, in Switzerland, and in Britain. Greece, with smaller reserves, faces similar challenges regarding the repatriation and full management of its gold.

Finally, Italy’s experience shows that the independence of central banks and international obligations create constraints on the use of gold for state needs. In Greece, as in Italy, the issue remains critical: who ultimately controls the gold and what is its role in the country’s economic sovereignty?

Where the European gold reserves are located

www.bankingnews.gr

Σχόλια αναγνωστών