The personal fortune of Donald Trump is reportedly said to have surged by 140 million dollars amid broader market shifts and his own activities in crypto.

On 3 January, the world watched in stunned disbelief the news that the president of Venezuela, Nicolás Maduro, had been arrested by US forces.

It was a dramatic geopolitical event that would reverberate not only in Washington and Caracas, but deep within the global financial markets.

Financial speculation erupted across prediction platforms, bond markets and even cryptocurrencies.

It was a fever that, for some, translated into enormous profits amounting to billions of dollars, something that has been occurring since 2023.

At the same time, the personal fortune of Donald Trump is reported to have skyrocketed amid the broader market movements and his own activities in crypto.

It was reported that the value of the US president’s crypto related assets may have increased by 140 million dollars following the operation in Venezuela.

This fits into a broader trend of rapid growth in digital assets associated with the president and his family.

Politics, speculation and individual enrichment

What this episode reveals is not only how geopolitics shapes markets, but also how tightly intertwined political power, speculation and personal wealth have become.

This matters not only for investors but also for ordinary citizens.

The future of the world has rarely been so uncertain, but according to the American economist Frank Knight, uncertainty is the road to profit.

Betting platforms

Prediction markets, as is well known, are platforms where people bet on political or real world outcomes.

Users can buy and sell shares that represent yes or no answers to the outcome of anything from sporting events and celebrity news to political upheavals.

On Polymarket, an online prediction market, an anonymous trader turned a bet of approximately 34,000 dollars into more than 400,000 dollars by wagering that Maduro would be overthrown by the end of January.

Polymarket later announced, however, that the bets on Maduro’s arrest did not meet the criteria and that no winnings would be paid out.

In its statement, it said that the bet concerned “US military operations with the aim of establishing control” in Venezuela.

Nevertheless, the prospect of such profits shocked the financial press.

How did this user know?

Was it simply luck, or did someone with inside information act first?

This fueled debate over whether prediction markets are legitimate mechanisms for aggregating information or loosely regulated gambling platforms that lend themselves to ethically questionable profits from insider trading.

Cryptocurrencies

Cryptocurrencies and prediction markets overlap in other ways as well.

Many of these platforms, including those backed by or acquired by major crypto players, operate on blockchain infrastructure and allow bets in digital assets.

Trump’s push to loosen regulatory oversight has, during his term, generally benefited crypto markets.

Although it is far too early to quantify any direct impact on his personal assets, the symbolic link between political risk and crypto valuations is undeniable for investors who see turmoil as volatility from which they can profit.

In Washington, however, lawmakers are now proposing restrictions on insider trading, specifically for prediction platforms.

Turning crisis into money

If prediction markets are the high risk, high return edge of this story, the surge in Venezuelan government bonds is the equivalent in the financial mainstream.

Oil markets

For years, the Venezuelan government and the state oil company Petróleos de Venezuela SA (PDVSA) had defaulted on billions in debt payments, with bonds trading at massive discounts.

When Maduro was arrested and the prospect of a political reset appeared real, these distressed bonds soared.

Some rose by nearly 20% as investors saw prospects for debt restructuring or the easing of US sanctions.

Hedge funds and other institutional investors that had taken positions in this battered debt suddenly found themselves on the threshold of significant gains.

This was not a bet on an election or a crypto token, it was a political event that altered expectations about credit risk.

Bond bets

It is the kind of speculation that made headlines during the sovereign debt crises of the 1990s and again in Greek bonds during the Eurozone crisis.

But rarely does one see such dramatic moves linked to a single operation.

The rise in bonds shows how modern markets price in geopolitical risk, when regime change appeared possible, investors bet that the new status quo would restore economic relations, unlock oil revenues and legitimize Venezuela’s debt.

The fact that this surge came so quickly after the operation shows how sensitive markets are to political surprises.

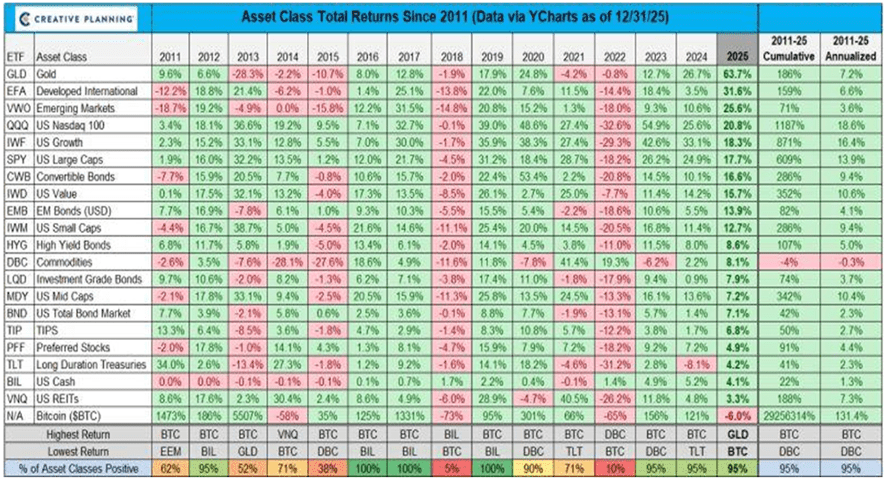

Beyond prediction bets and bond traders, a third wave of speculation spilled into energy stocks and broader markets.

Oil and Wall Street

American companies, particularly Chevron, which already has interests in Venezuela, saw their shares soar as investors priced in the possibility that the USA could gain access to the country’s vast oil reserves.

Reports that Washington might exercise temporary control over Venezuela’s oil sales further reinforced this narrative, pushing energy stock indices and broader equity indices higher in the days following the operation.

The rise was not universal, global oil prices were more restrained and at times even fell as markets assessed oversupply scenarios.

However, the general trend was clear, geopolitical change in a major oil producing country quickly raised hopes for higher share prices for certain energy companies.

This is not merely Wall optimism, it reflects real strategic thinking about how a post Maduro Venezuela could unlock tens of millions of barrels of oil and reignite investment in one of the largest reserves in the world.

It is a reminder that behind seemingly chaotic headlines, markets are always trying to price future economic reality into the present.

The arrest of Maduro was as much a financial event as a political one.

It revealed how deeply intertwined markets and geopolitics are, and how great the profit is for those who can read the signals first.

www.bankingnews.gr

Σχόλια αναγνωστών