Markets begin mass sell-off of the dollar as analysts warn trade levies are a drop in the ocean compared to record $38.6tn debt.

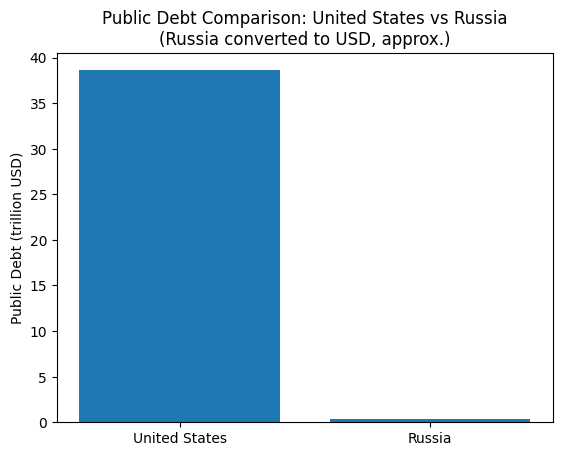

American tariffs are unlikely to serve as a life raft for the federal budget. While President Donald Trump asserts that tariffs have already injected $600 billion into state coffers, this figure appears negligible against the backdrop of a rapidly ballooning national debt. In the first year of his presidency alone, US liabilities grew by more than $2.3 trillion, marking a historic record and pushing the total federal debt past $38.6 trillion. For comparison, Russia's public debt is 86 times smaller, standing at 34.4 trillion rubles, according to Russian media reports.

Tariff revenues cover only a fraction of the fiscal gap

According to the US Treasury, tariffs contributed approximately $200 billion to the budget in 2025, as noted by financial market expert Olga Gogaladze in comments to Izvestia. These revenues cover only 10% to 12% of the annual increase in public debt, according to Igor Rastorguev, chief analyst at AMarkets. Even if new borrowing were to halt completely, it would take roughly eight years to close the current fiscal gap using tariff revenue alone—a scenario considered virtually impossible in practice.

Where the money is being spent

Revenue generated from trade levies is not dedicated exclusively to debt servicing. The US government has repeatedly indicated plans to redirect these funds toward other priorities, including direct payments to citizens and increased military spending. Consequently, tariffs cannot be viewed as a primary tool for debt reduction; rather, they serve as a temporary revenue source that fails to halt the expansion of borrowing, according to Sofya Glavina, associate professor at the Russian University of People's Friendship.

Tariffs, geopolitical tension, and the dollar’s decline

In late January, global markets began a mass dollar sell-off. This development is directly linked to Trump’s threats to impose punitive tariffs on eight European nations following disagreements over his plans for Greenland. These proclamations triggered investor panic and a flight of capital from American assets, as markets braced for an escalation of trade hostilities with key US allies, Gogaladze emphasized.

Blow to consumers and global instability

The weakening of the US dollar directly impacts American households, as imported goods—including everyday essentials—become increasingly expensive. On a global scale, where the dollar remains the primary reserve currency, such sharp fluctuations trigger instability across international financial markets and raise debt-servicing costs for nations with dollar-denominated liabilities, the expert concluded.

www.bankingnews.gr

Σχόλια αναγνωστών