The European Central Bank (ECB) on Saturday 14 February presented plans to expand access to its euro liquidity backstop, making it globally available and permanent, with the aim of strengthening the international role of the single currency and challenging the monopoly of the Federal Reserve.

The liquidity backstop is a financial instrument that functions as a “safety valve” for banks or central banks, providing immediate access to liquidity, typically in euros in the case of the ECB, when funding markets become unusually constrained or unstable.

Access to such repo liquidity lines, which are of critical importance for financing during periods of market turbulence, had until now been limited to only a few countries, mainly in Eastern Europe.

ECB President Christine Lagarde has long viewed this capability as a tool for expanding the global reach of the euro.

“The ECB must be prepared for a more volatile environment”, Lagarde stated during the Munich Security Conference, marking the first time that an ECB head explicitly addressed the issue.

“We must avoid situations where pressure in markets leads to sales of euro denominated securities, undermining the transmission of our monetary policy”.

Lender of last resort

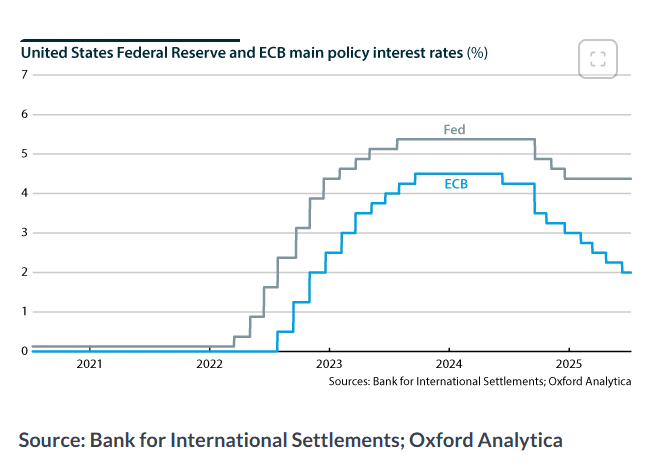

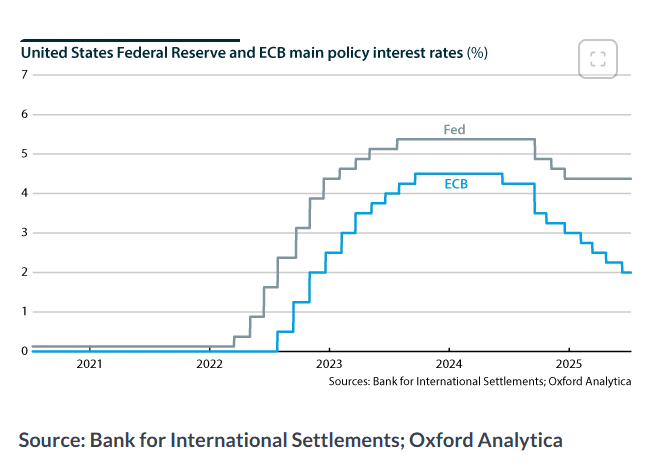

The significance of this development is not immediately obvious without understanding that the US Federal Reserve effectively functions as a “global bank” due to the reserve status of the dollar, channeling liquidity into the global economy to stabilize the banking system and maintain smooth credit conditions.

This occurred during both the 2008/2009 financial crisis and the COVID-19 crisis.

This means that the Federal Reserve holds the keys to global liquidity, a form of financial “nuclear weapon”, capable of destabilizing banking systems by restricting liquidity flows.

Under new conditions of geopolitical competition, such as tensions surrounding President Donald Trump’s position on Greenland, monetary authorities are preparing for a conflict over the shaping of credit conditions and liquidity.

Access to 50 billion euros

The new facility will become available in the third quarter of 2026 and will be open to all central banks globally, except those excluded for reputational reasons, such as money laundering, terrorist financing, or international sanctions.

The instrument will provide permanent access of up to 50 billion euros, unlike previous arrangements that required periodic renewal.

Lagarde emphasized that the availability of a “lender of last resort” for central banks worldwide enhances confidence in euro denominated investments, borrowing, and transactions, knowing that access will remain secure during disruptions.

With investors reassessing the role of the dollar due to the unpredictable policies of Donald Trump, Lagarde noted that this represents an opportunity for the euro to gain greater global market share, requiring a redesign of the EU’s financial and economic architecture.

The ECB highlighted that guaranteed access to euros may deepen markets, increase demand for euro denominated assets, and encourage banks outside the euro area to acquire securities issued within the bloc.

Capital wars

According to reports, leading investors in Northern Europe are reexamining their exposure to US assets, while pension funds from Scandinavia and other countries have already reduced holdings of US Treasury bonds.

Part of this development is attributed to concerns about US debt, however the Greenland crisis triggered by Trump and his continued unpredictability have also intensified voices in Europe calling for the use of European capital as a strategic weapon, in what Ray Dalio described as capital wars.

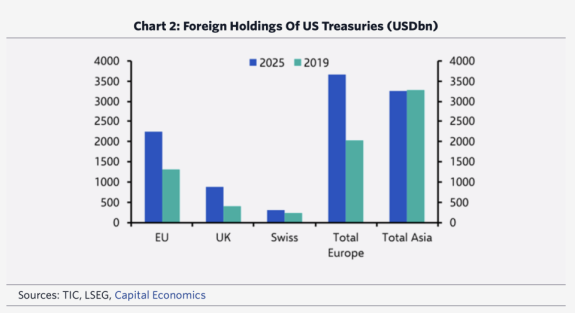

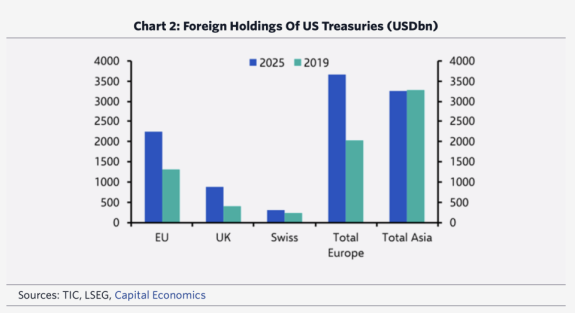

European investors currently hold approximately 8 trillion dollars in US equities and bonds, of which 3,6 trillion dollars relate specifically to US Treasury debt.

Europe represents roughly one third of US government bonds held abroad, nearly 10% of the total Treasuries market, having almost doubled its positions since 2019, according to a note by Capital Economics published on Wednesday 21 January 2026.

However, precisely this massive stockpile makes an abrupt sale of US bonds by European investors unlikely, since the movement of such large scale capital would trigger severe disruptions in global financial markets.

Why the United States holds an escalation advantage

A shift toward alternative investments would send their prices soaring and reduce expected returns, the note states.

Other “safe havens”, such as the Swiss franc and gold, have already appreciated to such an extent that they offer negative real returns.

“Not only would this entail a financial cost, but it would also trigger a response of the same type: American investors also hold large amounts of European sovereign bonds”, added the Deputy Chief Markets Economist of Capital Economics, Jonas Goltermann.

“Beyond that, European banks continue to depend on dollar funding, which is ultimately supported by the Federal Reserve as lender of last resort.

The “escalation advantage”, to use a military term, clearly favors the United States, which means that whoever can lose the most will win in an escalation of the conflict.”

Michael Brown, Senior Research Strategist at Pepperstone, also pointed out that a significant portion of European allocations to American assets serves collateral or liquidity management needs rather than discretionary investment choices.

Moreover, even in cases of discretionary investments, American assets are held by private investors, a fact that makes the imposition of state directives for their sale nearly impossible, he noted in a related commentary.

How the strategy could boomerang

If Europe were to liquidate the American government bonds it holds, bond prices would collapse “in an extremely violent manner”, with secondary effects elsewhere as well, including the Eurozone, where borrowing costs would surge.

At the same time, foreign exchange markets would face severe turbulence, as the euro would appreciate abruptly, delivering a serious blow to exports and the economic growth of the Eurozone, Brown added.

“A more realistic option, provided that capital markets were seriously considered as a means of European retaliation, would be an ‘abstention from the markets’ at upcoming American bond auctions, although even this would be relatively difficult to implement in practice”, he concluded.

The train of the great escape for Scandinavian funds

The Scandinavian region hosts some of the largest pension funds in Europe based on assets under management.

This week, two Scandinavian pension funds, Sweden’s Alecta and Denmark’s AkademikerPension, announced that they have sold or are in the process of selling the American government bonds they held.

“We are having many discussions with clients about whether this is the appropriate time to reduce their exposure to American assets”, stated Van Luu, Global Head of Fixed Income and Currency Strategy at Russell Investments, which advises pension schemes.

“Approximately 50% of them are evaluating whether they should take action”, particularly clients from Northern Europe, including Scandinavia and the Netherlands, he added.

Russell Investments, headquartered in Seattle, advises clients with assets totaling 1,6 trillion dollars and directly manages 636 billion dollars.

The value of the American government bonds held by the Dutch pension fund ABP, the largest in Europe, fell sharply from the end of 2024 to September of the previous year, most likely due to a reduction of its positions.

Scandinavian funds appear more willing than others to publicly express their stance toward American assets.

Alecta stated that it sold the majority of its American bonds because the risk associated with American Treasuries and the dollar has increased, while AkademikerPension reported that it will liquidate its positions by the end of the month, attributing the decision to the fiscal weakness of the American government.

AkademikerPension emphasized that this move is not intended as a political statement linked to the dispute between Denmark and the United States over Greenland.

The public nature of the discussion surrounding American assets is unusual for investors, who typically avoid commenting on portfolio changes that may be related to current developments.

The above means that the nuclear option for Europe is not immediately likely, but it remains in play if geopolitical confrontation with the United States intensifies.

www.bankingnews.gr

Σχόλια αναγνωστών